Comprehensive Credit Counselling Services with EDUdebt in Singapore

Comprehending Credit Rating Coaching: Exactly How Specialist Assistance Can Help You Take Care Of Financial Debt Efficiently

Debt coaching offers as an essential source for individuals grappling with financial obligation, providing tailored strategies made to address their specific economic difficulties. The nuances of exactly how credit scores counselling runs and the criteria for picking the ideal counsellor commonly stay unclear.

What Is Credit Rating Coaching?

During the therapy sessions, clients are urged to discuss their economic obstacles openly, enabling the counsellor to analyze their monetary health thoroughly. This analysis usually causes the advancement of an organized strategy that details actions for decreasing financial obligation, enhancing cost savings, and attaining long-term financial stability. Credit counsellors might additionally facilitate interaction with creditors, aiding clients bargain extra desirable settlement terms or financial obligation negotiations.

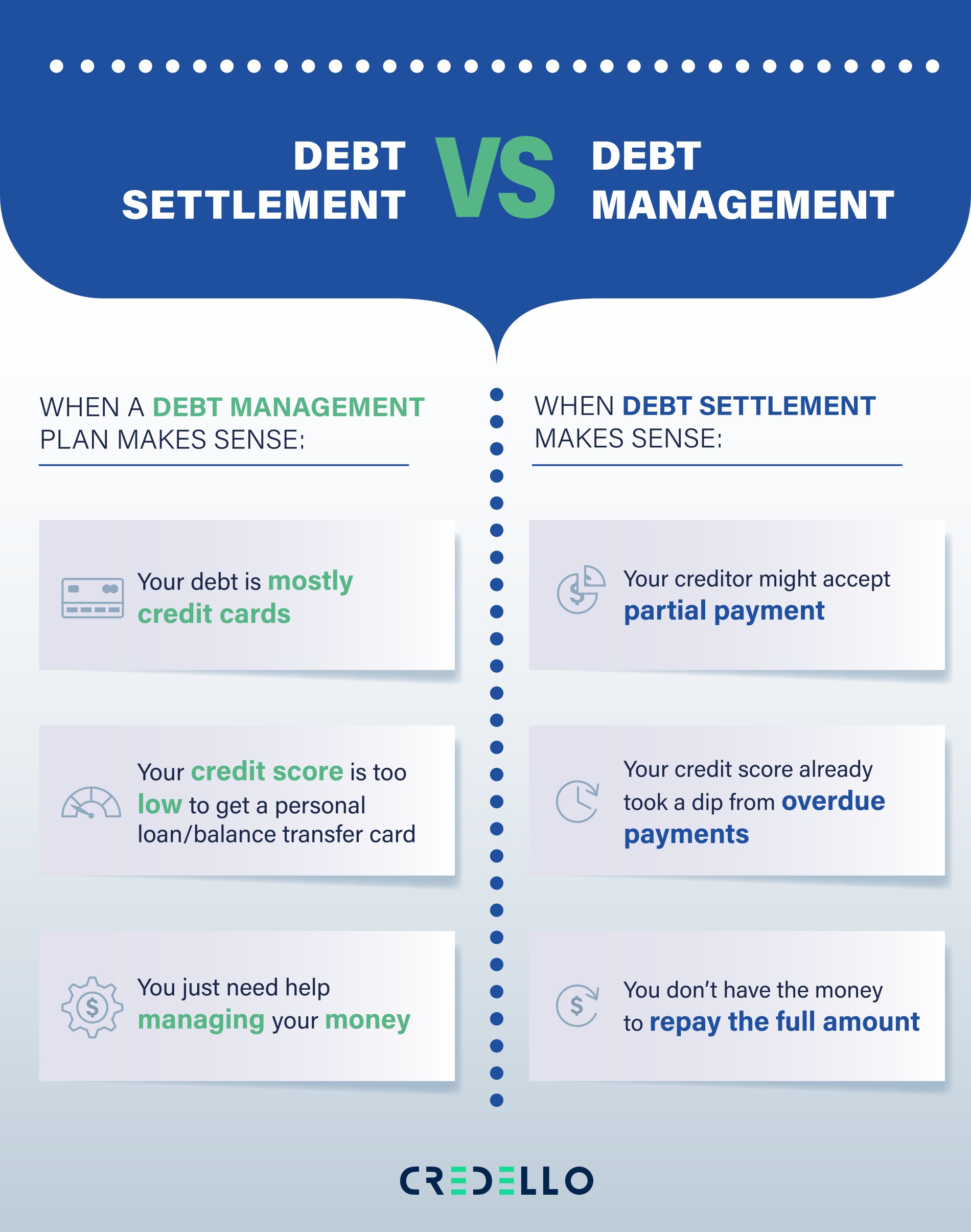

Credit scores therapy stands out from financial obligation negotiation or bankruptcy services, focusing rather on empowering people with the knowledge and tools required to gain back control over their finances. By cultivating financial proficiency, credit rating therapy not only addresses instant financial obligation issues but additionally equips customers with abilities to make educated economic choices in the future.

Advantages of Credit Scores Coaching

One of the crucial advantages of credit history coaching is its capability to provide people with tailored methods for managing their monetary challenges. By evaluating a person's unique economic circumstance, credit report counsellors can develop personalized strategies that resolve certain financial debts, income levels, and spending habits. This individualized approach aids clients acquire a clearer understanding of their financial landscape.

In addition, credit therapy commonly results in improved monetary proficiency. Clients obtain education on budgeting, saving, and liable credit report usage, which empowers them to make educated decisions in the future. credit counselling services with EDUdebt. This expertise can cultivate long-lasting financial stability and self-confidence

Credit scores counselling can also help with negotiations with lenders, potentially causing lowered rate of interest prices or more convenient repayment plans. This can ease the immediate tension connected with frustrating debt and offer a more clear path toward monetary healing.

How Credit Rating Counselling Works

The procedure of credit rating therapy normally starts with a first assessment of a customer's monetary situation, that includes an extensive review of their revenue, costs, debts, and credit rating. This foundational action permits the credit rating counsellor to comprehend the customer's one-of-a-kind economic landscape and identify locations requiring renovation.

Adhering to the analysis, the credit scores counsellor works together with the our website client to establish a tailored action plan. This plan might include budgeting techniques, debt monitoring methods, and recommendations for boosting credit report. The counsellor may likewise discuss with financial institutions on part of the customer to develop a lot more positive repayment terms or lower rate of interest.

Throughout the counselling process, clients are educated on monetary proficiency, outfitting them with the understanding required to make informed choices moving on. Regular follow-up sessions are essential, making certain the customer stays on track with their financial objectives and can adjust the plan as situations alter.

Eventually, credit report counselling aims to empower clients, helping them restore control of their funds and leading the way for a more protected financial future. By providing expert assistance, credit scores counsellors play an important duty in assisting in reliable debt administration.

Choosing the Right Debt Counsellor

Picking an ideal credit counsellor is a substantial action in the trip toward financial stability. Look for counsellors associated with trusted companies such as the National Foundation for Debt Therapy (NFCC) or the Financial Therapy Association of America (FCAA), as these associations often show a commitment to honest standards.

Following, think about the counsellor's experience and know-how in managing your specific monetary issues. Arrange appointments to assess their technique and interaction style; reliable credit therapy should foster a sense of count on and understanding. During these conferences, inquire about their costs and payment structures to make certain openness and to prevent unforeseen costs.

Furthermore, seek reviews and reviews from previous customers to assess the counsellor's performance and approachability. Lastly, guarantee that the counsellor provides a thorough variety of solutions, consisting of budgeting support, debt monitoring plans, and monetary education and learning sources. By very carefully assessing these variables, you can pick a credit counsellor who aligns with your monetary requirements and goals, leading the way for a much more safe and secure monetary future.

Success Stories and Reviews

Several individuals have actually located restored hope and stability through their experiences with credit history therapy. Testimonies from customers find out this here typically highlight transformative trips where frustrating financial obligation was changed with monetary quality and confidence. For circumstances, one customer shared just how a credit history counsellor aided them design a tailored budget, dramatically minimizing their month-to-month expenses and permitting them to designate funds in the direction of settling financial obligations. This tactical approach empowered them to reclaim control over their monetary situation.

One more success tale includes a family that sought debt therapy after encountering unanticipated clinical expenditures. With specialist support, they were able to bargain with creditors, leading to reduced rate of interest and workable payment strategies. The family revealed thankfulness for not only relieving their monetary burden but also recovering harmony within their home.

Moreover, lots of customers report boosted credit history as a direct result of sticking to the techniques given by their debt counsellors. These real-life examples show the extensive impact that professional assistance can carry people having problem with debt (credit counselling services check out here with EDUdebt). As they browse their financial journeys, these success stories offer as a testimony to the effectiveness of debt coaching in promoting lasting monetary wellness and resilience

Final Thought

By giving customized monetary advice and education, licensed credit history counsellors empower customers to create efficient debt monitoring techniques. The benefits of credit score therapy extend past instant relief, fostering lasting monetary stability and proficiency.

Credit history coaching is a monetary solution developed to aid individuals in managing their financial obligations and boosting their overall economic literacy. The key goal of credit scores counselling is to enlighten clients on different economic ideas, consisting of budgeting, financial obligation monitoring, and the ramifications of credit score scores.

By carefully assessing these factors, you can select a credit scores counsellor that aligns with your monetary demands and goals, leading the means for an extra protected economic future.

Furthermore, numerous clients report enhanced credit report ratings as a straight result of adhering to the methods supplied by their credit report counsellors. As they browse their economic trips, these success tales offer as a testimony to the effectiveness of credit history therapy in promoting lasting monetary health and wellness and durability.